Given price declines since the peak of the housing market in February 2022, homebuyers are finding good opportunities in the Brampton, Toronto and GTA markets. However, our higher rate environment has resulted in a tougher stress test, which makes it difficult for homebuyers to qualify for the mortgage they need so they can capitalize on those opportunities. That’s why it’s important to get mortgage ready as early in the homebuying process as possible.

Here are some important tips to help you prepare for mortgage qualifying:

1.Get your credit in tip top shape.

First get a copy of your credit report so you know how you will be viewed by lenders. You can order yours online at Equifax or Transunion. If you spot a problem, contact the credit agency as soon as you can to resolve the issue.

You can boost your score by several points quickly with continual good credit habits:

- Pay your bills on time, every time. This habit carries the most weight when it comes to your credit score so be sure to take it seriously.

- Don’t let your credit accounts exceed 30% of the credit available. This applies to each account; you don’t want to be maxed out on one card and not using much of another.

- Before you cancel any credit cards, get advice. Having a long steady credit history is important.

- Don’t frequently apply for new credit, which includes never applying for a store card just to save on your purchase that day.

Make a habit of checking your credit score regularly and watch how those good credit habits push your credit score skywards!

2. Focus on your downpayment

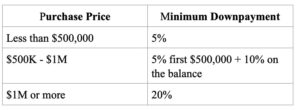

Plan to go into homeownership with the maximum downpayment possible. But first, know how much downpayment you need. The minimum downpayment requirements are based on purchase price:

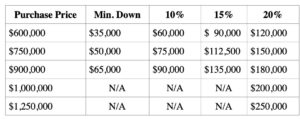

Downpayment examples:

You are also required to have “default mortgage insurance” if your downpayment is less than 20%. The premium, which starts at 4% for a 5% downpayment and declines to 3.1% at 10% down and 2.8% at 15% down, is added to your mortgage amount and increases your mortgage payment. If you have 20% down, you are not required to have mortgage default insurance.

If you are looking to boost your downpayment, consider these strategies:

- Getting help from family. Your parents or grandparents may be willing to help by gifting all your downpayment, or by helping you paydown other debts. Only a parent or other blood relatives like your grandparents can gift you downpayment money. And you’ll need a signed gift letter that says the funds are a gift and you are not required to pay the money back at any time. In other words, the money is a gift, not a loan.

You could also consider asking your parents to be a cosigner, which involves adding their credit history and income to your application. The co-signer will be put on the title of the home and your lender will consider this person equally responsible for the mortgage. - Use your RRSP. You can withdraw up to $35,000 tax-free from your RRSP or $70,000 per couple with the Federal Home Buyers Program (HBP) if the money has been inside the RRSP for at least 90 days.

3. Determine your purchasing power

It’s a great idea to get a pre-approval so you know the amount of mortgage you qualify for and can shop within your budget. You’ll also know what your monthly payments will be and have security that your interest rate will be held for a specified period i.e., 120 days. While it does offer some reassurance, keep in mind that a pre-approval is not a mortgage approval. Your lender will need to assess the property you are purchasing. Additionally, be sure to not make significant changes after getting the pre-approval i.e., changing jobs, adding debt, or missing payments, co-signing another loan, or using your down payment money.

4. Prepare a budget

One of the biggest lessons learned by many home homebuyers was that they should have been more thorough when budgeting and accounting for all the costs of homeownership. Having a budget is one of the most important ways to achieve a solid financial future. It might not be the most fun task, but it’s one that will give you a clearer picture of where you stand and how much mortgage you can truly afford. First and foremost, make sure you can afford your pre-approved amount or if you should consider buying a less expensive home.

You also need to make sure you budget for the added costs that come with the purchase of a home. Generally, you can expect to pay between 2 – 4% of the home’s selling price in total closing costs. Your budget must also account for your monthly homeownership expenses, like home insurance, property taxes, utilities, and ongoing maintenance.

5. Start gathering your documents

Assembling everything your lender needs to verify your income and downpayment is a critical part of mortgage success. A last-minute scramble for documents just adds stress.

For those with a full-time salary, you’ll need to provide a recent pay stub and a “letter of employment” on company letterhead that confirms your position, your annual salary, and the length of time you’ve been in your position. If you’re a new employee, lenders will want to know that your probationary period is over. If you have commissions and bonuses, these can be proven by your last two notices of tax assessments.

If you are self-employed, get in touch to discuss the documents you will have to submit.

You will also need to supply proof of your downpayment, which will include a 3-month history of any bank account(s) where you have been assembling your downpayment. It’s critical that your name is linked to the account so be careful with internet print outs.

6. Get in touch early

I want to help you be fully prepared to get you where you want to go, and to make sure you can take advantage of any opportunities that come your way in Brampton, Toronto and the GTA. Contact me today!