Navigating a move can be both a daunting task and a costly endeavour, encompassing expenses like legal fees, moving costs, real estate commissions, decorating, furnishings, and more. At times, it just proves more practical to appreciate and enhance your current home rather than listing it for sale, especially if you love your neighbourhood.

For those thinking of renovating, there are two primary financing avenues – home equity and unsecured credit. The housing marketing in Brampton, Toronto, and the GTA have experienced significant growth over the last 5 to 10 years, giving homeowners substantial equity, and many are capitalizing on this opportunity by leveraging their equity gains. Using home equity for renovations allows you to tailor your home to suit your lifestyle, while at the same time bolstering long-term property value.

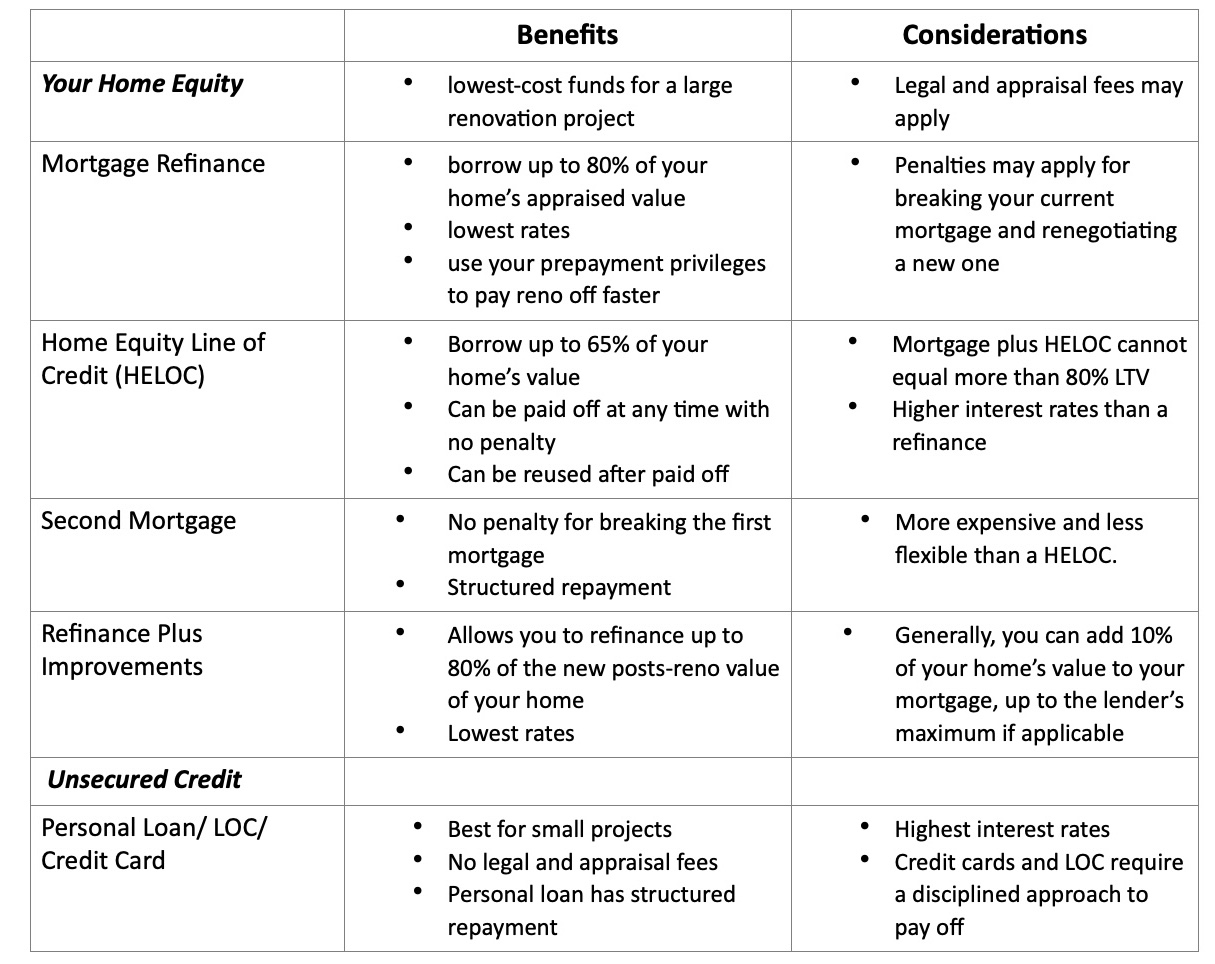

When looking to access home equity, homeowners have several options, such as mortgage refinancing, a home equity line of credit, a second mortgage, or a program known as refinance plus improvements. Alternatively, for smaller-scale projects, you can opt for unsecured credit options like personal loans, lines of credit, or credit cards.

Here’s a detailed breakdown of the benefits and considerations for each financing option:

Brampton Mortgage Broker Rakhi Madan is here to help!

When it comes to your home renovation, make sure you have a knowledgeable and trusted advisor by your side. As Brampton’s best Mortgage Broker, Rakhi Madan brings a wealth of experience, making her the go-to expert for discussing renovation financing. With a track record of delivering exceptional service and earning high Google ratings, Rakhi ensures her clients receive the utmost customer service. Whether you’re exploring the benefits of using your home equity or unsecured credit options, Rakhi’s expertise and dedication guarantee a seamless journey toward transforming your home. Trust in experience and customer satisfaction; trust Rakhi Madan to guide you through financing your exciting renovation project.