First off, yes you do if you are buying in one of these areas:

- Ajax

- Mississauga

- Aurora

- Mono

- Bradford West Gwillimbury

- New Tecumseth

- Brampton

- Newmarket

- Caledon

- Oakville

- Chippewas of Georgina Island First Nation

- Orangeville

- East Gwillimbury

- Pickering

- Georgina

- Richmond Hill

- Halton Hills

- Toronto

- King

- Uxbridge

- Markham

- Vaughan

- Milton

- Whitchurch-Stouffville

Now let’s do a refresher on the program. The first-time buyer incentive is a federal government shared equity program designed to reduce mortgage payments for qualifying first-time buyers who have the minimum 5 percent down payment required for an insured mortgage. The program will provide 5 percent of the cost of an existing home, or 10 percent of a new home. This incentive isn’t payable until you sell the property and is not charged interest.

While the program has been around for a while, the government just enhanced it for Toronto, Vancouver, and Victoria Census Metropolitan Areas, effective May 3rd 2021.

You are eligible for this enhanced version of the program if:

- you or your partner are a first-time homebuyer.

- you are a Canadian citizen, permanent resident or non-permanent resident authorized to work in Canada.

- you meet the minimum down payment requirement of 5% with traditional funds.

- you are buying in one of the three designated census metropolitan areas.

- your household income can’t be more than $150,000, and your total borrowed amount can’t be more than 4.5 times your household income.

With a household income of $150,000, the maximum purchase price would be approximately $722,000 with 5 percent down and about $794,000 for a 14.99 percent down payment. The maximum down payment for the 10 percent incentive is 9.99 percent and 14.99 percent for 5 percent down.

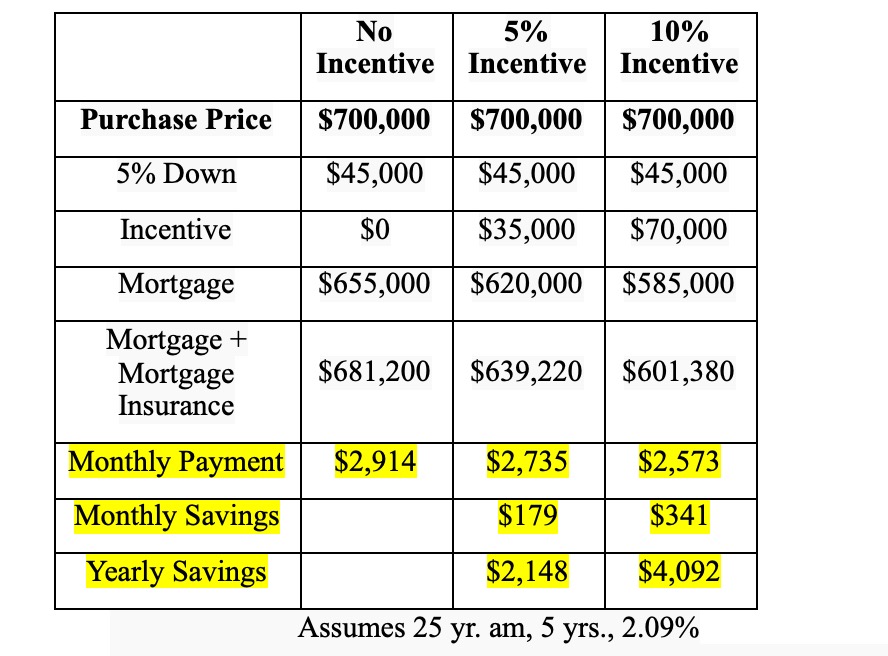

You benefit through a lower monthly mortgage payment, and your cost of mortgage default insurance is slightly less since your first mortgage amount is reduced by the amount of the incentive. Here is how the savings look:

You are required to pay the incentive back after 25 years or when you sell the home, with the repayment amount based on the property’s fair market value, whether it has increased or decreased in value. If you received a 5 percent incentive and your $700,000 home increases in value to $800,000, then you are required to repay $40,000. If the value deceases to $650,000, you’ll repay $32,500. You can repay the incentive at any time without penalty.

Since repayment is based on market value at the time of repayment, you may want to repay early if your home is increasing in value quickly, or prior to conducting major renovations.

Got a homebuying dream and live in Brampton, Toronto or the GTA? Feel free to contact me for a review of your situation at any time! I’m here to help and can certainly run some numbers to determine if this is something you may want to consider.