While nothing is certain, Bank of Canada cuts to the overnight rate are on tap for 2024, possibly starting in April. The strong potential for rate cuts has made variable and adjustable mortgages a top consideration for some homebuyers and homeowners because these mortgages move in conjunction with the prime rate, which in turn is set based on the overnight rate. The case gets stronger with each anticipated Bank of Canada rate cut.

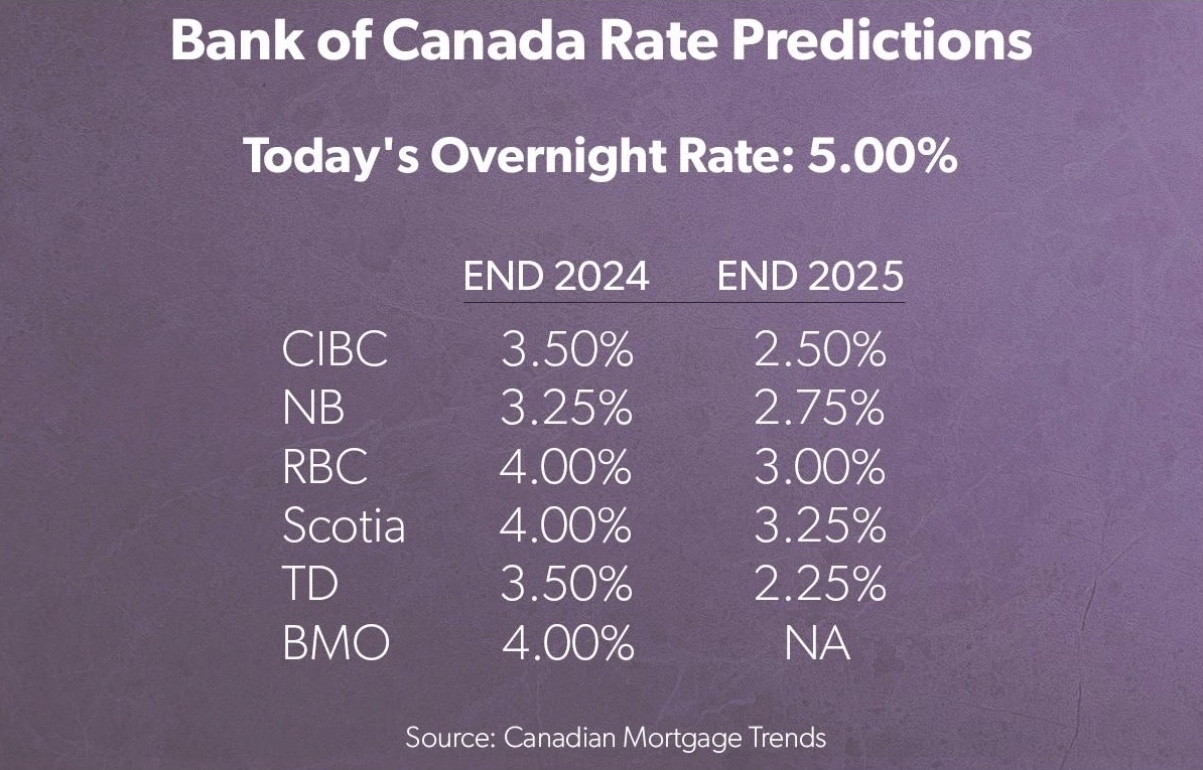

All top economists are predicting rate cuts. Here are the Bank of Canada rate projections for 2024 and 2025 by the major Canadian Banks.

Should we get 1.75% in rate cuts as projected by the National Bank or even 1.5% as projected by CIBC and TD, the case for variable and adjustable is strong. You want to choose a variable when you believe the overnight rate will fall below today’s fixed rates and with enough time left on your term to recover your higher initial payments.

To complicate matters, there are two types of variable mortgages, one referred to as “variable” and the other called an adjustable mortgage.

With an adjustable mortgage, when the Bank of Canada lowers rates, your monthly payment is reduced accordingly, giving you a nice cash flow boost. This is a great option for those with tight budgets and who stretched their finances to purchase their home.

With a variable mortgage, your payments do not change when the Bank of Canada lowers rates. When rates do drop, you pay off more principal with each payment, allowing you to pay off your mortgage and become mortgage-free much quicker.

Variable/adjustable mortgages allow you to hedge your bets by giving you the option to move to a fixed-rate mortgage at any time should you feel that is the best move for you. The biggest advantage of these mortgages may be their lower fee to break the mortgage should you need to get out compared to a fixed rate mortgage where penalties to break the mortgage can be severe. Life can be uncertain so if you feel there could be changes down the road i.e. a spousal breakup or a move to a new city, you may want to consider the lower fees to get out of a variable mortgage in your decision-making process.

When Fixed Rate Mortgages are the Best Option

For some homeowners, especially first-time homebuyers, the uncertainty is not for them. Variables are also not suitable for those who cannot afford for rate predictions to be wrong, and they either don’t drop or don’t drop quickly enough. Fixed-rate mortgages are the preferred choice for risk-averse homebuyers and owners because of their stability and predictability.

With a fixed interest rate that remains constant throughout the mortgage term, borrowers are protected from fluctuations in the market. This consistency allows for accurate budgeting and planning. After getting your mortgage, you never have to think about rates again until renewal.

What is a Hybrid Mortgage

The hybrid mortgage strikes a balance by including features of both fixed and variable mortgages, offering a balanced solution. You get to set your percentage for the fixed and variable portions. The fixed portion of the mortgage will have a consistent interest rate throughout the mortgage term. The remaining percentage is allocated to the variable portion, where the interest rate will fluctuate based on the prime rate and the Bank of Canada overnight rate.

This unique mortgage option provides a middle ground for borrowers who want stability and predictability with a fixed rate, while also having the opportunity to benefit from interest rate decreases with the variable portion. It’s kind of like having a diversified investment portfolio.

The bottom line is that the hybrid option offers a degree of insurance against the worst-case scenario, while still allowing you to capitalize on the likelihood of lower rates. You also get the benefit of the lower fee to break your mortgage on the variable component and you can lock that portion into fixed at any time should you feel the need to do so.

What’s Best for You?

When it comes to your mortgage choices – fixed, variable, or hybrid – the decision hinges on your financial strategy. With potential Bank of Canada rate cuts in 2024, variable and adjustable mortgages gain prominence, offering advantages like lowered monthly payments and faster mortgage payoffs.

Yet, fixed-rate mortgages remain a stalwart choice for stability, especially for risk-averse individuals seeking predictability until renewal.

Enter the hybrid mortgage, a versatile blend of fixed and variable features, providing a middle ground for stability and flexibility. It combines the consistency of a fixed rate with the potential for savings from variable rate decreases.

For tailored advice aligned with your financial goals and risk tolerance, turn to Brampton’s best Mortgage Broker, Rakhi Madan. Whether you prefer stability, embrace potential savings, or seek a balanced approach, Rakhi Madan ensures personalized guidance for an informed decision. Trust in her expertise to navigate the diverse mortgage landscape and secure a financial path aligned with your goals and risk tolerance. Get the advice you deserve!