Finally, the first rate cut in four years to the Bank of Canada’s overnight rate! With this cut and more on the horizon, homebuyers and homeowners in Brampton, Toronto, and the GTA are reconsidering their mortgage options. While the past few years have seen a preference for 3-year fixed mortgages, we’re now seeing the landscape shift. Variable and adjustable-rate mortgages are becoming more attractive. Understanding the differences between these mortgage types and their benefits can help homebuyers and those looking to refinance or renew make an informed decision that aligns with their financial goals.

Rate Cuts Incoming

As the Bank of Canada begins the rate-cutting cycle, borrowers with variable and adjustable-rate mortgages benefit each time there is a rate cut. Why? The interest rate for these mortgages fluctuates based on the lender’s prime rate, which moves along with the Bank of Canada overnight rate, set eight times a year. As a result, when the Bank of Canada cuts rates, your mortgage payments change, leading to improved cash flow or faster mortgage paydown depending on the type of mortgage you choose.

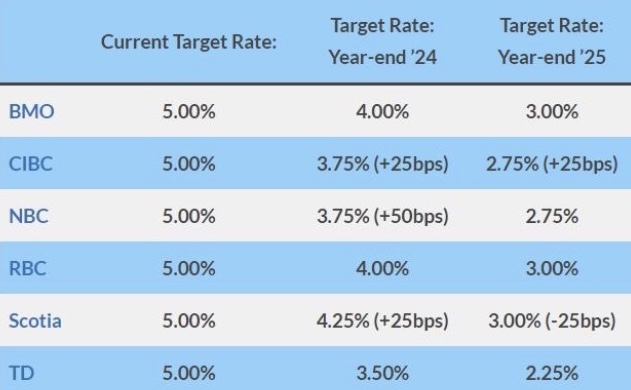

How quickly will rates drop? No one knows for certain, but it’s useful to consider what the major Canadian Banks are projecting. This gives you an idea of where your variable or adjustable mortgage will stand rate-wise at the end of 2024 and 2025.

There are four more rate decisions before the end of this year. Some Banks are projecting three more cuts, while TD sees five more quarter-point cuts. While the overnight rate is likely headed for around 3.0%, it is important to consider that the overnight rate is not expected to reach the pre-COVID overnight rate of 1.75%.

Major Banks Rate Projections – Bank of Canada Overnight Rate

Source: Canadian Mortgage Trends June 2024

Understanding the Differences: It’s important to distinguish between variable-rate mortgages and adjustable-rate mortgages:

- Variable-Rate Mortgage:

- Adjustable-Rate Mortgage:

With a variable-rate mortgage, your interest rate is tied to the lender’s prime rate, which can change after each Bank of Canada rate announcement. However, your monthly payments remain constant when the prime rate goes up or down. So how are you affected? If interest rates drop, a larger portion of your payment goes toward your principal, helping you pay off your mortgage faster. Conversely, if rates rise, more of your payment goes toward interest and it’ll take longer to pay off your mortgage, though your monthly payment amount remains the same.

A major lender does allow variable borrowers to request a payment drop if it doesn’t extend their scheduled amortization.

An adjustable-rate mortgage also fluctuates with the prime rate, but unlike a variable-rate mortgage, the monthly payments adjust as well. This means your payment amount can increase or decrease in response to interest rate changes. When rates decline, your monthly payments decrease, providing immediate relief to your cash flow. When rates rise, each payment will pay more interest and less principal.

Lower Prepayment Privileges

One of the significant advantages of variable and adjustable-rate mortgages over fixed-rate mortgages is their typically lower prepayment penalties. Fixed-rate mortgages often have higher penalties when you break your mortgage early, as lenders want to recoup the interest they would lose. Variable and adjustable-rate mortgages usually have more flexible terms and lower penalties for early prepayment, allowing you to get out of your mortgage without incurring substantial fees should you need to because of life circumstances.

Ability to Switch to a Fixed-Rate Mortgage

Variable and adjustable-rate mortgages also allow you to hedge your bets by enabling you to move to a fixed-rate mortgage at any time should you feel that is the best move for you. This flexibility ensures that if market conditions change, or if you prefer the stability of fixed payments, you can switch without waiting for the term to end.

What About Fixed Rates?

With a fixed-rate mortgage, your interest rate and monthly payments remain constant throughout the term, regardless of market rate changes. While this provides stability, you won’t benefit from Bank of Canada rate cuts, as your payments stay the same even when rates drop. And fixed rates are not based on the prime rate but on the 5-year government of Canada Bond yield. While prime and the 5-year Bond often rise and fall at similar times, the prime rate typically only changes eight times a year while bond yields can change daily.

A key advantage to five-year fixed mortgages is that they tend to have lower rates because of the long lock-in period, making it easier to qualify under the government’s mortgage stress test. Some borrowers opt for a 5-year fixed because they have no other options.

Risk tolerance is a very important factor. If your budget is tight, locking in may be the best move. You could sign up for a fixed term of three years or longer or explore a hybrid mortgage. With a hybrid mortgage, part of your mortgage is fixed, and the other portion is variable, enabling you to hedge your bets.

Flexibility and Savings are the Bottom Line

Variable and adjustable mortgages offer greater flexibility compared to fixed-rate mortgages. With interest rates expected to decrease, opting for a variable or adjustable-rate mortgage will allow you to capitalize as the prime rate declines over time. You’ll benefit from market conditions and save money over the long term.

As we move forward with this rate-cutting environment, it may be time to reassess your current mortgage plan or take a fresh look at your options if you need a new mortgage. Variable and adjustable-rate mortgages, with their potential for flexibility and lower payments or faster mortgage paydown, will become increasingly appealing. Understanding their differences and benefits can help you make an informed decision. That’s why it is so important to speak with Brampton’s best Mortgage Broker, Rakhi Madan. Ultimately, the choice between fixed, variable, or adjustable depends on your circumstances and risk tolerance. For personalized advice and to explore which mortgage option is best for you, trust Rakhi Madan to be your dedicated partner. You want to be prepared for the current and upcoming interest rate environment.

Stay ahead of the curve and ensure your mortgage strategy aligns with the changing market. Talk to Rakhi today!