You’ve decided to become a proud first-time homeowner! That’s exciting news. Get a solid start on achieving your dream with professional mortgage advice. I specialize in helping first-time homebuyers in Brampton, Toronto and the GTA navigate this complex process, taking the time needed to make sure you can make the most informed decisions possible.

There are many things to think about when buying your first home; here are some of your most important considerations:

What can you afford?

Before you start shopping for a home – and long before you consider putting an offer on one – I can help you determine how much home you can comfortably afford. With a pre-approved mortgage, you’ll know the mortgage amount you qualify for and how much it will cost you to carry the mortgage. You’ll also get your interest rate guaranteed for a set period, typically 90 to 120 days.

To get pre-approved, you’ll need to provide detail on your income, your assets, and the current amount of debt you are carrying. Your pre-approval won’t be an actual mortgage approval because your lender will need to assess the property you want to buy and verify your financial situation and downpayment amount.

Your downpayment

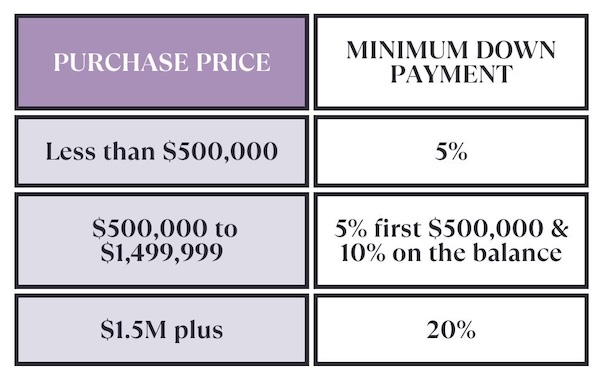

Understanding how much downpayment you need is one of your most important considerations before you look to purchase your new home. Your minimum downpayment will be based on your purchase price:

Here’s an example. If your purchase price is $500,000, your minimum downpayment is $25,000. At $900,00 you’ll need to put down $25,000 for the first $500,000 and 10% on the remainder, which is $40,000 for a total minimum downpayment of $65,000. At $1.2 million the minimum downpayment requirement is $95,000, and with a purchase price of $1.5 million, your minimum downpayment climbs to $300,000 (20% down).

If your downpayment is between 5% and 20%, it’s also a rule that you have default mortgage insurance. This premium will be added to your mortgage amount and increase your mortgage payments. At a 5% downpayment, the mortgage insurance premium will be 4%, declining to 3.1% at 10 percent down and 2.8% at fifteen percent down. With a 20% downpayment, default mortgage insurance is not required.

If you’re in the “saving up” stage of preparing for home ownership, this is a great time to discuss your downpayment options. If the funds are coming from your savings, you will need to provide a 90-day history of bank statements. Many buyers also receive part or all of their down payment as a gift from a parent or close relative. In this case, you’ll need a signed letter from the giver stating the money is a gift and doesn’t need to be repaid.

Your credit score is important!

When applying for a mortgage, there is another important factor beyond your income and downpayment. Your lender will look at your credit history. Having good credit can not only get you approved for your mortgage but also give you access to the lowest rates available. Make sure to brush up on how to keep your credit strong before you start your homeownership journey.

Build a team of professionals

It’s important to have a strong away team so that all aspects of your home buying experience are efficient and professional. Your team will include a realtor, lawyer, and a home inspector. I can refer you to top notch professionals in Brampton, Toronto and the GTA.

Plan for closing costs

There are additional costs that come with buying a home like legal fees and land transfer tax, so you’ll need to have extra funds set aside to cover these costs. Generally, you can expect to pay between 1.5% and 4% of the home’s selling price in total closing costs. Many homebuyers often reflect that they weren’t prepared for these costs and that’s why I make sure you fully understand all the costs associated with buying your first home.

Beyond the monthly payment

Remember that home ownership involves costs beyond the monthly mortgage payment such at utility bills, insurance, taxes, home upkeep. Take the time to get understand all of your annual costs, and imagine that sum on top of your mortgage payment. Put a budget together so you know what your situation will look like monthly.

Buying a Fixer Upper?

There is a very helpful and often overlooked option called a Purchase Plus Improvements Mortgage that will allow you to complete your renovations before you move into your home. This product allows you to roll some or all of the costs of your renovation into your mortgage, instead of racking up your line of credit or credit cards.

Check out available incentives

There are various first-time buyer incentives that can help with your downpayment and closing/home costs. Be sure to check them out and see if there are any that can benefit your situation.

Let’s get started!

Making your first purchase can be exhilarating – and intimidating. Let me be your guide as you embark on this exciting journey. As an experienced mortgage professional in Brampton, Toronto and the GTA, it’s my mission to provide top-level support so you can confidently realize the dream of owning your very own home. Let me help make this process enjoyable for you!