Yes, we are in uncertain times. The recent .5% increase to the Bank of Canada overnight rate was expected but each increase can be unsettling, even though we haven’t yet reached pre-pandemic levels.

While many in Brampton, Toronto and the GTA are viewing our current economic environment as a time of caution, others see a period of opportunity. Regardless of how you are feeling, this is the perfect time to make sure you have good credit behaviours. When there is some anxiety, it’s important to focus on what you can control, like your credit rating. With the right actions, you can make sure your credit is in tip top shape.

Let’s remember why your credit is so important. Lenders use your credit score to determine what kind of risk you are likely to be as a borrower. A strong score will help you qualify for the best mortgage rates available should you need a new mortgage or want to switch to a new lender for a better deal. Scores range from 300 to 900, with 680 or higher putting you in a very favourable position with lenders.

So where do you start? First, you may want to look at your credit history, so you know what your lender sees. There can be reporting errors that you can fix which is why it’s a good idea to take this initiative. Getting an incorrect history cleaned up can positively impact you score quite quickly. You can request a free copy of your credit report by mail from either Equifax or TransUnion. You can get your online score by subscribing to either credit agency.

How else can you control your credit score? Be sure to focus on these key credit behaviours:

- Pay your bills on time and never miss a payment. This is the single biggest factor in your credit score. Set up automatic payments or mark it on your calendar. This one habit carries the most weight when it comes to your credit score so be sure to take it seriously. It’s particularly important to never have a bill go to collections, which is a huge black mark. If you’re having trouble paying, talk to the creditor about a negotiated payment plan.

- Keep your utilization low. What does this mean? Your credit score is based on your balance relative to the total amount of credit available. That’s why you need to know what your credit limits are. If the credit card company gives you a credit limit of $10,000, create your own limit of $3,000: or no more than 30% of the available funds.

Do you have more than one credit facility? Balance them out. It’s better to be at 30% on three cards than have one at the limit and two that are never used. You want to show that you are using all your credit but in a wisely manner. - Accept credit increases since it further lowers your utilization, but only do this if it doesn’t encourage added spending.

- Don’t frequently apply for too much credit since that can show desperation. Watch out for store cards that offer you to save on your purchase that day. Don’t take credit on an impulse.

- Having a long steady credit history is important because the longer you’ve had a card, the clearer the picture is of how you manage your debt. That’s why you may not want to cancel your oldest card. Always get advice before you cancel any card or close a line of credit.

- If you have bruised credit, a secured credit card will allow you to establish or re-establish a solid credit rating. These cards require a deposit so the cardholder can never be in default.

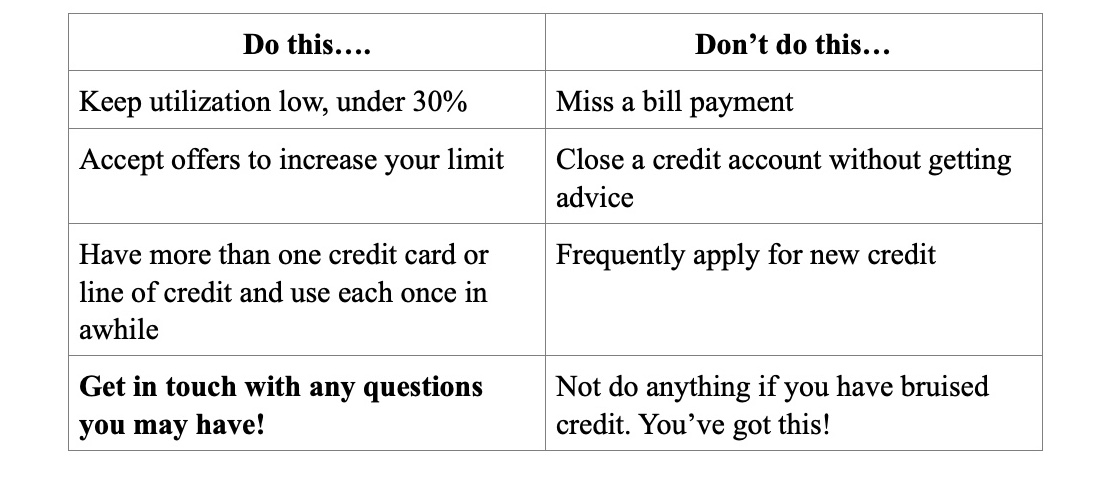

Here is a summary of what to do and not to do for top notch credit behaviours:

And the good news is …. credit agencies receive data every day so it’s possible to see changes in your score daily, which means you can boost your credit relatively quickly.

Do you have credit problems and need a mortgage now? Sometimes, a difficult past is standing in the way of a bright future. Bad credit can do that to you.

If you’re running into roadblocks or don’t think you can get mortgage financing that you need now, don’t give up. It is possible to get a mortgage with bad credit. And it can be a very important step in getting you back on track financially should you need to pay off a significant amount of high-interest debt.

One of the primary advantages of working with a Brampton mortgage broker is the access you get to a wide range of lenders, including institutional and private lenders that specialize in bad credit mortgages. While the guidelines are different for each, these lenders look at your overall situation and entire credit history, and some will consider your application even after a consumer proposal or bankruptcy.

Keep in mind that even though you will have a higher interest rate and may pay additional fees, bad credit mortgages are typically short term i.e., 1 year. During this time, we can work together to improve your score and then look to move you to a better rate longer-term mortgage.

If your situation is such that you simply don’t qualify, there are ways you can make up for bad credit, which include:

1. Increasing your downpayment to 20 per cent or more.

2. Asking a trusted friend or family member to be a co-signer. Your co-signer will need a good credit score and have the capacity to be responsible for the mortgage if you are unable to handle the payments.

3. Or consider taking the time needed to repair your credit first. A much-improved credit situation can save you the cost of a higher interest rate and less favourable terms.

If you are preparing to purchase a home, refinance or switch your mortgage, I would be happy to advise how your current situation will be viewed by lenders. If needed, I can outline your best options for credit improvement. Let’s chart a course to get you where you want to go. I want to ensure that as many people as possible in Brampton, Toronto and the GTA can achieve their dream of home ownership and financial security. Contact me today!