How to

FINANCE YOUR DREAM HOME

…with the least amount

of stress and cost!

First Time Home Buyers Guide Canada

Congratulations

ON YOUR DECISION TO BUY A NEW HOME!

Like any broker, I have mortgage expertise — but how I put that expertise to work makes all the difference. I actively manage the entire process and continue a real service relationship after your mortgage closes. I will help you make educated decisions along the way and I will always look for ways to save you money. You can expect a different experience with me as your Mortgage Broker. I strive to build my business through repeat and word-of-mouth

referrals, which allows me to always put my customers first with a dedicated focus.

My industry influence gives you many advantages:

- Access to 80 different lenders

- 7,200 mortgage options

- Close relationships and clout with lenders and insurers

Allow me to make your mortgage experience simple, comfortable and above all successful! My clients’ happiness is the key to success. Let me be the key to yours!

Contents

Click on a section heading below to jump down to that section of the guide.

Pre-Approval: What’s Your Purchasing Power

Downpayment Savings Strategies

Mortgage Payment Options

All About The Mortgage Process

Verify Your Downpayment

Let Renters Help Pay Your Mortgage

Downpayment: How Much Do you Need?

Fixed or Variable-Rate Mortgage?

Good Credit is Important

Verify Your Income

What Should You Know About Rates?

What You Should and Shouldn’t Do Before Your Mortgage Funds

APPENDIX A | Mortgage Glossary

What is my “Qualifying Rate”?

What are “Closing Costs”?

What is a “Purchase Plus Improvements Mortgage”?

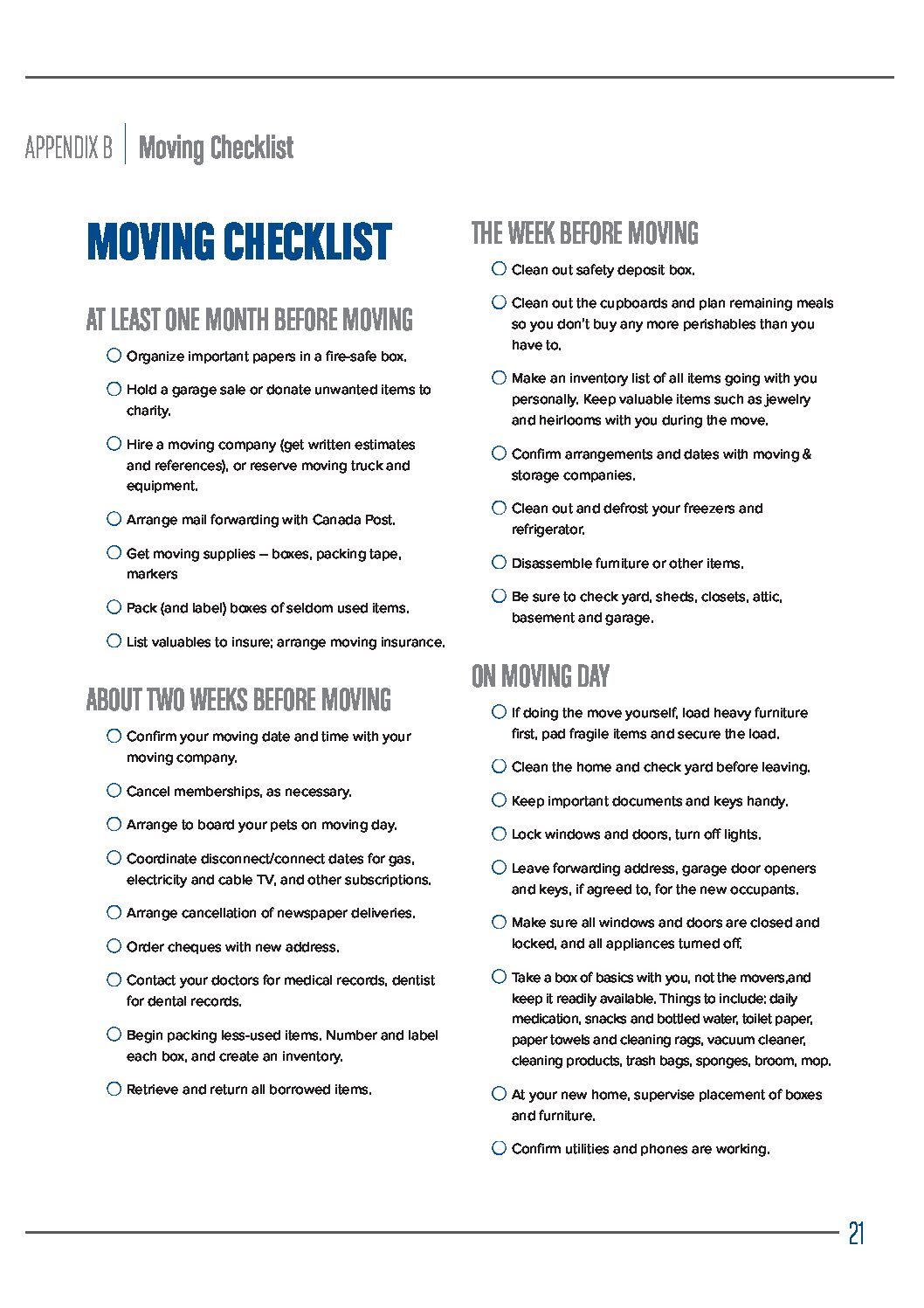

APPENDIX B | Moving Checklist

Moving Checklist

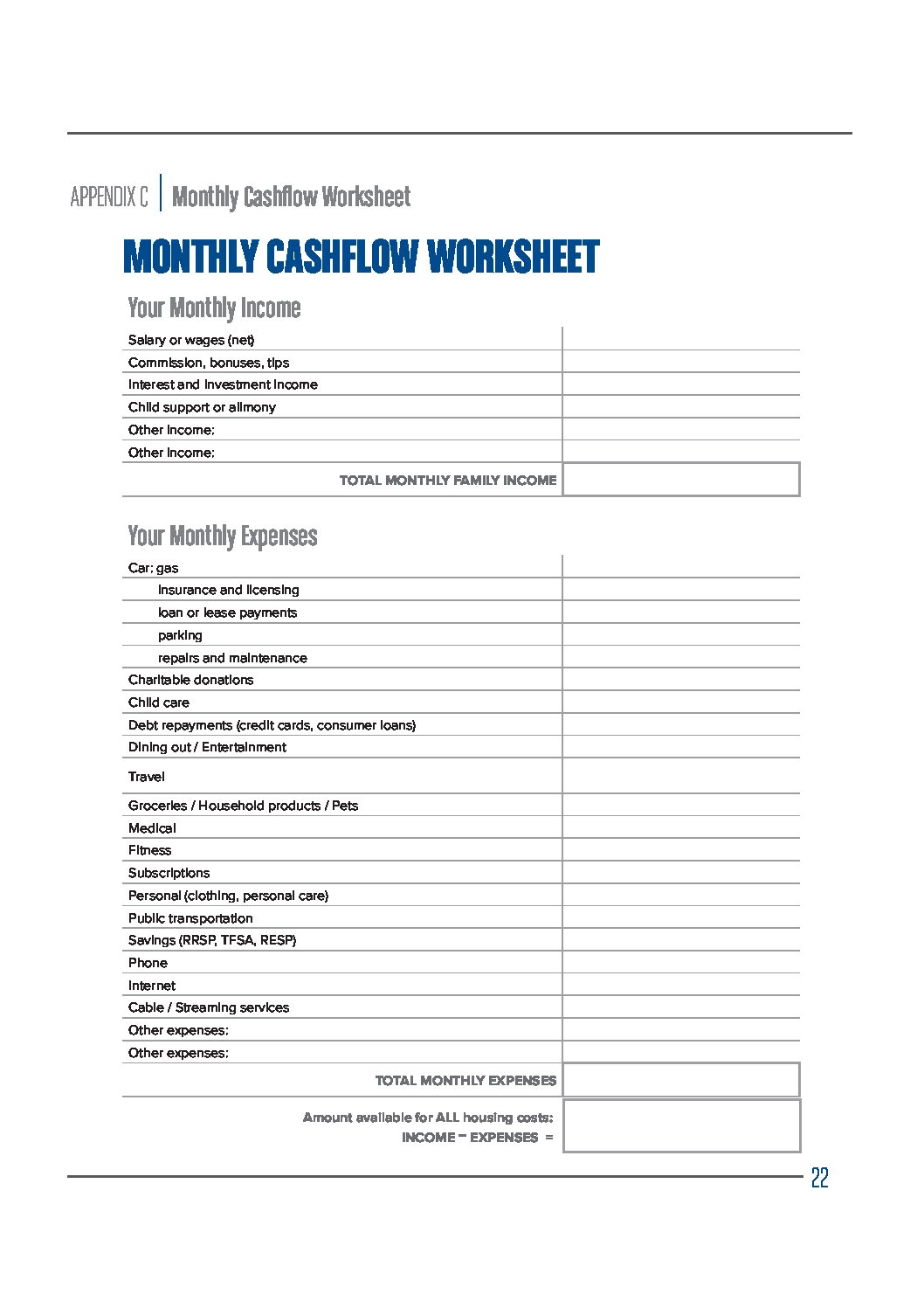

APPENDIX C | Monthly Cashflow Worksheet

Monthly Cashflow Worksheet

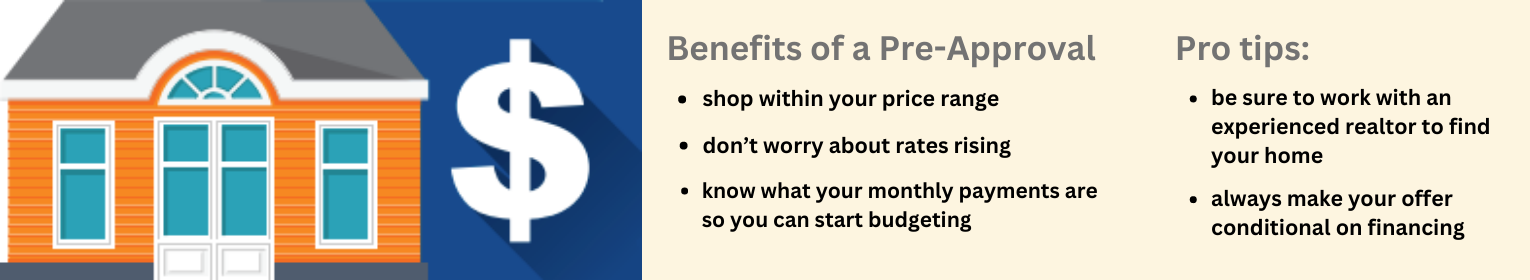

WHAT’S YOUR PURCHASING POWER?

Go shopping with a full wallet!

Before you go house hunting, I can advise you how much mortgage you will likely qualify for, what your monthly payments will be, and can give you a rate hold for a specified period of time i.e. 120 days. This way you can shop within your price range, you don’t have to worry about rates rising, and both realtors and sellers will know you’re serious. You also won’t waste any of your valuable time looking at houses that are out of your price range. You can confidently shop for your home and act on that perfect opportunity And by not underestimating what you can afford now, you can save over the long term if you don’t need to purchase a trade-up home later.

Pre-approvals do provide some security, but always remember to make your offer conditional on financing because your property will need to be assessed by your lender, and that condition gives us time to finalize your mortgage.

Will you need a co-signer?

It’s not always easy to qualify for a mortgage on your own merits. You may have a strong downpayment and good income and credit score, but sometimes that still may not be enough. Increasingly buyers are using a cosigner, which involves adding the support of another person’s credit history and income to your application. The co-signer is placed on the title of the home and the lender considers this person equally responsible for the mortgage.

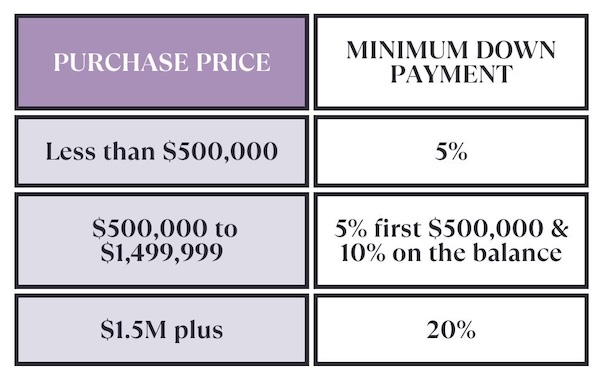

HOW MUCH DOWNPAYMENT DO YOU NEED?

What if the house you want is more than $500,000? Good question. Because the rules change. For any home over $500,000 but less than $1.5 million, you need 5% on the first $500,000… which is always going to be $25,000. And then you’re going to need ten percent for any amount over that.

So if your house price is $800,000, you’ll need your $25,000 plus ten percent of the extra $300,000… which is $30,000.That means you’re going to need to save up $55,000 for your downpayment. For a $1.1 million house, your minimum down is $85,000.

If your purchase price is $1.5 million or more, a minimum 20% downpayment is required.

These minimum downpayment amounts are Government of Canada rules, and they’re designed to maintain a good, stable housing market. And that’s why there is another important government requirement. If your downpayment is between 5% and 20%, it’s also a rule that you have “default mortgage insurance.” The premium is almost always added to your mortgage amount. This insurance is there to protect the lender.

Here’s an example, if your purchase price is $800,000 and you have the minimum down, your mortgage amount is $745,000. The mortgage insurance premium will be 4% percent or $28,800, which is then added to your mortgage, bringing your total mortgage amount to $773,800. The insurance premium declines to 3.1% (at 10% down) and 2.8% (at 15% down). If you’ve saved up more than 20% of the purchase price, then there’s no premium, because you’ve got lots of equity in the house as a buffer if anything goes wrong. Having 20% downpayment is a good goal, but today, most first-time homebuyers are purchasing their homes with the minimum required downpayment.

DOWNPAYMENT SAVINGS STRATEGIES

A Gift From a Family Member

Perhaps you have someone willing to gift you the funds for your downpayment. That’s great… here are a few important requirements that your lender will have. Only a parent or other blood relatives like your grandparents can actually give you that money. And you’ll need a signed gift letter that says the funds are a gift and you are not required to pay the money back at any time. In other words, the money is a gift… not a loan.

Borrow It From Your RRSP TAX FREE!

Another way to secure down payment funds is through your RRSP! The Federal Home Buyers’ Plan (HBP) allows first-time homebuyers to withdraw up to $60,000 tax-free from their RRSPs, provided the money has been in the RRSP for at least 90 days. If you’re purchasing a home with a partner who is also a first-time buyer, you can withdraw from each RRSP, giving you up to $120,000 towards your home.

If you have contribution room, you can deposit whatever funds you’ve already saved for your down payment (up to $60,000) into your RRSP just before the contribution deadline, usually March 1. The resulting tax refund will further increase the funds available for your home purchase. After 90 days, you can redeem your funds under the HBP. You must repay the withdrawn funds according to the repayment plan or pay the income tax.

Tax-Free First Home Savings Account (FHSA)

The FHSA is a terrific way to help future homebuyers get a head start on saving for their first home and make the dream of homeownership a reality. Qualified first-time homebuyers can contribute $8,000 per year for 5 years for a total of $40,000 or $80,000 for a couple. Your contribution room starts when you open a plan, and you can carry forward a maximum of $8,000 in unused contributions to the next year.

Like an RRSP, contributions are tax-deductible and, like a TFSA, all withdrawals which include investment growth will be non-taxable. There is no requirement to repay as there is with the RRSP Home Buyers’ Plan (HBP). You can use both the FHSA and the HBP for the same home purchase.

You can transfer money from your RRSP to your FHSA. This strategy gives you a tax-free RRSP withdrawal, although you don’t get a tax deduction for the transfer, and this does not affect your RRSP contribution room.

If you don’t end up purchasing a home, you can withdraw your money on a taxable basis or your account balance can be transferred to your RRSP, giving you additional RRSP contribution room.

FIXED OR VARIABLE-RATE MORTGAGE?

One of the first decisions homebuyers need to consider is whether to select a fixed or variable rate mortgage. The rates for each are often very different and that’s why it’s important to know the difference.

Fixed Rate

With a fixed-rate mortgage, you’ll know with absolute certainty what your rate and payment will be each month for the term of your mortgage, offering you stability and peace of mind. Since fixed rate mortgages are not affected by fluctuating interest rates, you can “set it and forget it.” Typically preferred by those on a tight budget, first-time buyers, or those who haven’t owned a home for a long time.

Variable Rate

A variable mortgage has an interest rate that moves along with your lender’s Prime rate, which tracks the Bank of Canada’s overnight rate, and is expressed as “prime minus x percent.” There are two types of variable-rate mortgages: one with fixed payments and one with adjustable payments.

With a variable mortgage with fixed payments, your payment amount remains the same even when interest rates change. Instead, the portion of your payment allocated to interest versus principal changes. When rates drop, more of your payment goes toward the principal; when rates rise, more goes toward paying interest. On the other hand, a variable mortgage with adjustable payments means that your payment amount will change whenever the interest rate changes, directly impacting your budget. Rate cuts lead to lower payments, while rate increases result in higher payments.

Given the uncertainty in predicting future rate movements, a variable-rate mortgage—whether with fixed or adjustable payments—is best suited if you have a flexible budget and can tolerate some risk.

30-year Amortizations

IT CAN BE A SMART FINANCIAL STRATEGY!

If you have less than a 20% downpayment, then you are required to have a 25-year amortization, which is the length of time you have to pay off your entire mortgage. If you have 20% down or more, you can choose a 30-year amortization, which allows you to minimize your mortgage payments and free up cash flow for uses like investing, business needs, post secondary education, maternity leave, home maintenance, or other life situations. You can keep your payments at a shorter amortization and only use this flexibility if the need arises. Having a mortgage that gives you room to breathe may be worth the cost in interest, and I can help you determine if this is right for you.

How do you get a 30-year amortization on an insured mortgage (less than 20% down)? You must be a first-time buyer or have experienced a marriage or common law breakup. You are also required to buy a new construction home. Effective December 15, 2024, extending payments over 30 years will be available for all first-time buyers, regardless of the type of home they buy.

MORTGAGE PAYMENT OPTIONS

BI-WEEKLY – monthly mortgage payment is multiplied by 12 months and divided by the 26 pay periods in a year. As a result, you make 26 payments per year.

ACCELERATED BI-WEEKLY – monthly mortgage payment is divided by two and the amount is withdrawn from your bank account every two weeks. With an accelerated bi-weekly mortgage payment, you still make 26 payments per year but the payment amount is slightly more than a regular bi-weekly mortgage payment.

WEEKLY – monthly mortgage payment is multiplied by 12 months and divided by the 52 weeks in a year for 52 payments in the year.

ACCELERATED WEEKLY – monthly mortgage payment is divided by four and the amount is withdrawn from your bank account every week. With an accelerated weekly mortgage payment, you still make 52 payments per year but the payment amount is slightly more than a regular weekly mortgage payment.

Paying off your mortgage faster

In addition to using accelerated payments to pay your mortgage off faster, you can also use your prepayment options, which include lump sum payments and increasing your mortgage payment.

Your mortgage contract will specify how much you can prepay each year.

What is the difference between regular and accelerated payments?

With an accelerated payment option, you end up making roughly one extra payment a year. It’ll cost you a little more on a monthly basis, but it will save you thousands in interest and help you pay off your mortgage even sooner. It’s this accelerated option that puts you in the direction of paying off your mortgage faster. But it’s important to consider your cash flow and the kind of life style you want to live while paying off your mortgage. If you feel as though accelerated payments would put too much pressure on your budget, then this might not be the best option for you.

GOOD CREDIT IS IMPORTANT

This important factor in your mortgage negotiation is entirely within your control. If you start right now with good credit habits, your rating will quickly improve. Here’s what’s important.

- Pay every bill on time. That one habit is your single biggest game-changer. Make a commitment to never let a bill get past due.

- Don’t run up your credit cards. Don’t run up your credit cards. Use the 30% rule. If your limit is $5,000, try not to let the card balance exceed $1,500. This practice helps maintain a good credit score and shows responsible credit usage.

- Don’t apply for credit too often. When you’re asked “would you like to apply for our Store Card to save on your purchase?” Don’t do it. These pitches can be a credit pitfall.

- Don’t ever let any bill go to collections, even if it’s for a small or disputed amount. These black marks on your credit are hard to erase. If it’s happened, be prepared to explain why, and be sure it’s paid in full and reported to Equifax.

- If you’ve ever been bankrupt or under a consumer proposal, you’re going to have some extra challenges. You’ll need to have been discharged for two full years. And you’ll need to prove that you’ve re-established credit after the discharge, with at least two re-established revolving credit items and a two year history of satisfactory repayment. Strong income and downpayment will help. I have access to lenders that specialize in this situation.

If you need to polish up your credit, get in touch for a review of your situation and actionable tips on how to boost your credit rating.

“To access the lowest mortgage rates, you need to show that you are a responsible borrower and will always make your mortgage payments on time.”

ALL ABOUT THE MORTGAGE PROCESS

I have fine-tuned my mortgage process to ensure an efficient and stress-free mortgage experience.

Here’s a quick overview:

Application

I get to know you, and you get to know me. Together we’ll discuss your situation, determine your goals and discuss how to best achieve them. I’ll also answer all of your questions. When we’re done, I’ll help you complete your mortgage application in whichever way you’d like – online, over the phone, or in person.

Review and Plan

I’ll go over your mortgage application with a fine-tooth comb. I’ll let you know about the documentation you’ll need to collect in order to secure your financing. Once I have all the documents, I’ll recommend the best lender with the right mortgage product for your needs.

Execution

I’ll submit your application to the selected lender. Once the lender has reviewed and approved your mortgage, I’ll take a close look at the approval with you. This will help us sort out all the lender’s conditions, and make sure they’re satisfied.

Funding and Follow Up

You’ll meet with your lawyer approximately a week before your mortgage closes. Once all the lender’s conditions are satisfied, they’ll submit the documents to be registered on title, transfer the funds, and the house is yours on closing day! Some brokers would say goodbye at this point, but I think your mortgage is way too important to leave you out in the cold. I’ll stay in touch all the way through, exploring every option to save you money and helping you prepare for the future.

Remember to arrange for home insurance!

It’s an important part of the mortgage process. Lenders in most cases require it before advancing funds.

VERIFY YOUR INCOME

If your income comes from a full-time salary, your proof of income is pretty simple. You’ll need a recent pay stub, along with a “letter of employment” on company letterhead that confirms your position, your annual salary, and the length of time you’ve been in your position.

If you’re a fairly new employee, lenders will want to know that your probationary period is over. Expect that your lender may call your employer. If you want to count your commissions and bonuses, also provide the last two notices of assessment so the lender can see what you expect to earn with these extras.

If your income is from commission, contract, part-time, hourly or seasonal employment, you’ll need a company letter describing your work, and a pay stub to prove your income. And because the lender will want to look at how consistent your income is, include your last two notices of assessment or T4 slips. If you work on contract, a copy of your contract and any renewals will be required.

If you’re self-employed, you’ll need two years of notices of assessment, a copy of your business license or registration; or articles of incorporation, if you’re incorporated. Also, provide a copy of your T1 general tax returns for the last two years, and the last two years of accountant-prepared financial statements (if you’re incorporated).

If your income is low or difficult to prove a bigger downpayment or an excellent credit history will definitely help bolster your case.

And don’t forget about other sources of income. For example, if you receive child support, have a copy of the separation/divorce agreement, and three to six months of bank statements to show the support being paid. This should count for less than 30% of your total income. Pension income can also be a very important source of income.

If you are on permanent disability, get a letter confirming permanent status, and bring along a paystub. If you’re on maternity leave, your lender might use your full employment income if you can bring a letter of employment confirming your plan to return to work within one year.

And finally, if it’s determined that you don’t have enough income to qualify for the mortgage amount you want, you can always check with family to see if they will go on title with you so you can use their income to help you qualify.

VERIFY YOUR DOWNPAYMENT

Once you are approved for your mortgage, your lender will want to be assured that you have not borrowed your downpayment, so be prepared to show where your downpayment is coming from.

If you’ve saved up the money, provide a 3-month history of the bank account(s) where the money has been building up. The statements should have your name on them; sometimes online banking printouts won’t show your name, so double-check.

If you’ve had any large deposits, show where they came from. If you transferred money from another account or sold investments, bring the records for those accounts too.

Got funds as a gift? Remember to have your signed gift letter. And bring a bank statement from the giver that will verify the funds. Don’t wait until the last minute; be sure the funds are in your account no later than 15 days before closing.

Using RRSP money? Provide a 3-month history of the account. Anything deposited in the last 90 days can’t be used for your deposit (or it will be fully taxed).

Getting your own money from outside Canada? Make sure it’s in your Canadian account at least 30 days before you need it, and be prepared to show the usual 3 months of records from the out-of-country account.

Planning to use the proceeds of the sale of your existing home? Provide a firm contract of purchase, and your current mortgage statement.

And last but not least: don’t use up your last dollar for the downpayment. You’ll need to prove that you have an extra 1.5% of the purchase price to cover closing costs, which may include legal fees, appraisal fee, transfer tax, home inspection, title insurance, interest adjustment, tax adjustment, and moving costs.

“You must be prepared

to show where

your downpayment is

coming from.”

WHAT YOU SHOULD KNOW ABOUT RATES

Without a doubt, even a small reduction in rate can mean interest savings over the life of your mortgage. And it is my specialty to seek out competitive rates from a wide range of lenders. But I also look deeper. Sometimes a cut-rate mortgage comes with higher fees, penalties, or restrictive terms, which could prove more costly over the long term than a mortgage with flexible terms.

One of the best ways to save interest, for example, is to use pre-payment options. Putting extra money against your mortgage principal could save you thousands of dollars in interest. If a cut-rate mortgage doesn’t permit pre-payments, that’s a huge missed opportunity.

Rates can be misleading and complex. The lowest rates aren’t available for all situations like conventional mortgages, refinances, 30 year amortizations, and rental properties.

I carefully examine mortgage features and privileges that best meet your personal situation, looking at:

Refinancing penalties

- Fixed vs variable rate

- Term

- Pre-payment options

- Payment flexibility

- Restrictions

- Fees

- Portability

- Assumability

I make sure your mortgage is custom-built for your personal situation, because the right combination of rate and features – matched to your needs – is the fastest route to mortgage freedom!

Be wary of the rates you see online

Rates are definitely used as a lure in online rate ads. But the reality is that once the fine print is read, many will find they don’t actually qualify for that rate, and often there are restrictions that could really cost homeowners in the long run. If you see an online rate ad, do all the research you can but be sure to call me to discuss. It’s my job to look out for your best interests.

LET RENTERS HELP PAY YOUR MORTGAGE

Whether you’re a first-time homebuyer feeling your way into the housing market or an existing one looking to lower your mortgage payment, here are five reasons why having renters help pay your mortgage is such an appealing option:

1. Some first-time buyers want to move directly into a single-family home and get mortgage assistance using a rental suite instead of purchasing a condo at a lower cost.

2. If you want to get your foot into the world of real estate without breaking the bank, a home with a rental suite

can be a great start, especially if the area you happen to love is pricey.

3. Homeowners looking ahead to the future may want to lower their mortgage cost so they can channel money into other investment areas like RRSPs, TFSAs, RESPs.

Or simply as a way to become mortgage free sooner!

4. Spending less on your mortgage can give you the freedom to change your lifestyle or follow your dreams, perhaps to travel, start a new business venture, or allow for the luxury of having a stay-at-home parent.

5. Rental suites are also great if you have aging parents. You can keep them close without infringing on personal space. Keep in mind that if tenants are family members, lenders and insurers will not use the rental income for qualifying purposes.

Ready to let renters help pay your mortgage? Talk to me today and find out how!

WHAT YOU SHOULD AND SHOULDN’T DO

BEFORE YOUR MORTGAGE FUNDS

It’s important to remember that even though you have an approved mortgage, it doesn’t fund until the day you close on your new home. Keep the following tips in mind to ensure a smooth closing:

1. Keep your bills up-to-date, including your current mortgage (if applicable).

2. Don’t add any new credit without consulting with me first, including

co-signing a loan.

3. Keep the money for your downpayment separate so you have

enough at closing to complete the purchase.

4. Have enough money set aside for other closing costs.

More on closing costs in Appendix A.

5. Don’t pack any important documents relating to your mortgage/home.

6. Just before funding is not a good time to quit your job, move to part-time, or reduce your income. If your employment situation has changed, please contact me right away.

7. Don’t change your closing date without telling me first, and remember to satisfy all conditions of your mortgage approval at least 10 business days before closing.

8. Get your home insurance in place, it’s an important part of your mortgage – lenders require it before advancing funds.

9. Talk to me about insuring this new debt with mortgage life and disability insurance.

10. Enjoy your new home!

APPENDIX A | Mortgage Glossary

WHAT IS MY…

“QUALIFYING RATE”

While mortgages have become more complex, this doesn’t mean that Canadians can’t get into their dream homes, consolidate debt, take out equity, or buy a second property. It just means that if you have an upcoming new mortgage need, we should discuss your plans as early as possible. I have access to many lenders that aren’t federally regulated and strategies that you can employ to improve your credit and ensure you are in the best situation possible when you need financing. I am here to help you so please get in touch at any time.

WHAT ARE…

“CLOSING COSTS”

One of the biggest lessons learned by many home homebuyers was that they should have been more thorough when budgeting and accounting for all of the costs of homeownership. Generally you need to set aside up to 1.5% of your home’s selling price in total closing costs, which can include:

- Appraisal fee

- Home inspection

- Land Transfer Tax. This amount can take buyers by surprise because the amount can be substantial. First-time buyers can apply for a partial rebate.

- Legal fees (including disbursements)

- Title insurance / Land survey

- Reimbursement of bills prepaid by the previous owner i.e. property tax or utility bills

- Interest adjustment

- PST on mortgage default insurance, which is 8% of your insurance premium and must be paid in full at closing. It is not added to your mortgage.

- HST on a new construction home, some of which may be recoverable.

- Utility hook ups

- Moving costs

- Furniture/appliances

When setting your budget, you also need to consider the ongoing costs that will become part of your monthly homeownership expenses, which include:

- Home insurance

- Property taxes

- Utilities – gas, hydro, water

- Internet/Streaming/Cable

- Ongoing maintenance

WHAT IS A…

“PURCHASE PLUS IMPROVEMENTS MORTGAGE”

Many homebuyers looking at older properties find themselves in a common predicament: they’ve found a property that suits them, but it needs some costly and immediate upgrades. Good news…

There is a mortgage that will keep you financially afloat!

A Purchase Plus Improvements Mortgage adds the cost of those immediate renovations into your mortgage, so you don’t have to rack up credit card bills or sell investments to pay for the upgrades. This mortgage will cover the sale price of the home, plus any renovations that would increase the value of the property, up to an approved amount. This way you can spread your payments over the life of the mortgage and have a cost-effective way to get into your dream home. You can then use your pre-payment privileges to pay the renovation off faster.

Here is an overview of the process:

1. Obtain cost estimates for the upgrades.

2. An appraisal with two separate values will be required: first the value of the property “as is” and the estimated value of the property once the improvements are completed.

3. Your lender will add the estimated cost of the renovation into your mortgage. The committed amount of the mortgage will be advanced to your solicitor, who will be instructed to hold back the renovation funds until the work has been completed and inspected.

4. Complete your upgrades; funds are released upon completion.

5. There are options we can discuss for carrying your expenditures until the funds can be released.

So if you find a home with “great bones” that can be renovated into the home of your dreams, get in touch early. I’m here to make sure your homebuying journey has a happy ending.

Example

$700,000 purchase price

+$25,000 plus kitchen upgrade

$725,000 new value

– $47,500 minus downpayment (5% first $500,000, 10% on remaining $225,000)

$677,500

+$27,100 plus mortgage insurance

$704,600 total mortgage

Your monthly mortgage payment increases by only about $108. That’s a very cost-effective way to enjoy your new home and your new kitchen!

APPENDIX B | Moving Checklist

APPENDIX C | Monthly Cashflow Worksheet