If you are a Canadian homeowner who is struggling with debt, you are not alone. According to recent statistics, the average Canadian household owes almost $41,500 in consumer debt, which includes credit card debt, personal loans, and lines of credit. Managing multiple debts with high-interest rates can be overwhelming and stressful, leaving many in Brampton, Toronto, and the GTA feeling like they are stuck in a financial rut.

Fortunately, there is a solution that can help you take control of your finances and get out of debt faster – debt consolidation.

What is Debt Consolidation?

Debt consolidation is the process of combining multiple debts, such as credit cards, lines of credit, personal loans, and tax bills, into one new loan with a single monthly payment. The goal is to simplify the repayment process and lower the interest rate you are paying on your debts. You’ll streamline your finances and reduce the stress and burden of managing so many payments.

You can use the equity in your home to consolidate your debts through a mortgage refinance. This involves breaking your current mortgage and replacing it with a new larger mortgage that pays off the old mortgage and all outstanding debts, leaving you with only one payment to make each month. A minimum of 20% home equity is required to complete a refinance, and a prepayment penalty will apply when you break your mortgage.

If you have a low fixed-rate mortgage that you want to keep, and you don’t want to incur any penalties, another option is to consolidate your debts into a second mortgage or a HELOC, both of which are home equity loans. Your rate will be higher, but you may be further ahead by keeping your current rate and not paying a penalty.

Debt consolidation aims to improve your monthly cash flow, simplify your debt payments, and reduce the overall interest you pay on your debts. You can also help improve your credit score by showing lenders that you are taking responsibility for your debt management.

What is the Process?

Before you consolidate your debt, create a list of all debts, including how much is owed, current interest rates, and monthly payments. This information will help us determine if debt consolidation is right for you.

The next step is to apply for your new mortgage. Just like when you applied for your original mortgage, you will need to provide documentation to support your income, credit history, and debt. When approved, you will receive the funds, which will be used to pay off your existing debts.

Benefits of Debt Consolidation

There are several benefits to debt consolidation for homeowners, including:

- Improved cash flow. By paying off your high-interest debt and moving to a lower-rate mortgage that amortizes that debt over a longer period, you’ll pay less on your total debt each month. The cash flow savings can help you get through a tough spot or be used to reduce your mortgage or allow you to invest for the future.

- Lower your overall interest rate on your debt. You’ll eliminate the debt that is at extremely high-interest rates by moving all debts to a lower-rate mortgage, which is typically your lowest-cost borrowing option, giving your big interest savings over time.

- Simplified payments. Managing multiple debt payments can be challenging and stressful. When you consolidate those debts, you’ll be left with just one payment to make each month. This can simplify your financial life and reduce the risk of missing payments or incurring late fees. Additionally, having only one payment to make each month can make it easier for budget planning.

- Improved credit score. Your credit score is an essential factor when it comes to borrowing money. If you have multiple debts, your credit score may be suffering due to missed or overdue payments. When you consolidate your debt and always make timely payments, you can improve your credit score over time.

- Reduced stress. Debt can be a significant source of stress. By consolidating your debt and reducing your interest rates, you can alleviate some of this stress and feel more in control of your financial situation.

You’ll also get a nice fresh financial start and put yourself on track to start building wealth!

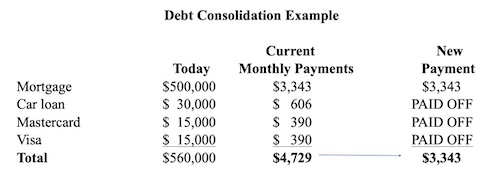

Here is an example of how multiple debts were rolled into a new mortgage. In this case, for example – mortgage, car loan, and credit cards total $560,000. Rolling that debt into a new $567,000 mortgage, including the fee to break the existing mortgage, provided this payoff:

Debt Consolidation Example

5.7% current variable mortgage, 5.14% new 3-year fixed-rate mortgage, 25-year am. Credit cards 19.9% and car loan 8%, both at A 5-year am. New mortgage includes $7,000 to break the current mortgage. OAC. Subject to change. For illustration purposes only.

By refinancing those high-interest debts, an impressive $1,386 in cash flow is saved every month. Not only have you reduced your total debt payment, but you’re also getting rid of hefty interest charges. Plus, all those burdening high-interest debts are gone for good. Just think about how you could channel some of that extra cash into paying off your mortgage, or invest in RRSPs, TFSAs, or RESPs. Then you’d be on the path to building long-term financial stability.

Just remember, once you’ve taken control of your finances, it’s crucial to stay disciplined and avoid piling up debt on your credit cards again. You don’t want to end up in the same boat as before, and this time with even more debt!

If you don’t have the mandatory 20% equity in your home, we can explore alternate options. With access to a range of lenders, including private ones, I am confident in my ability to find the ideal solution to suit your unique needs.

Get your financial fresh start!

If you are a homeowner in Brampton, Toronto, or the GTA struggling with debt, consolidating that debt into a new mortgage may be an excellent option for you. You can lower your interest rates, simplify your payments, improve your credit score, save money, and reduce stress. Take control of your finances and start working towards becoming more financially secure! Get in touch and allow me to give you a financial fresh start!

Here are the other top reasons homeowners consider refinancing their mortgage –

Lower Interest Rates: If you can qualify for a rate that is lower than your original mortgage, refinancing to a new mortgage with a lower interest rate or more favourable terms and conditions can save you money over the life of your mortgage.

Change in Financial Situation: A change in financial situation, such as a new job or an increase in income, may make it possible for you to afford a larger mortgage payment. Refinancing your mortgage can allow you to take advantage of this new financial situation. Or perhaps because of illness or divorce, you need some financial breathing room and want to take equity out to provide that relief.

Home Renovations: Homeowners also use refinancing to fund home renovations or improvements whether it’s to improve the quality of their lives, or for functionality like a new home office. Your renovations can also increase the value of your home, a nice added benefit.

Invest in the Future. If you’ve found the perfect cottage or the retirement home of your dreams, refinancing may be the way to make that purchase happen. Or perhaps you are thinking of a rental property for a long-term wealth-building opportunity and a source of retirement income.

You need funds. You may be able to get the funds you need for major expenses, like a new business, tuition, or wedding, often a better strategy than loading it all onto high-interest credit cards or an unsecured line of credit.