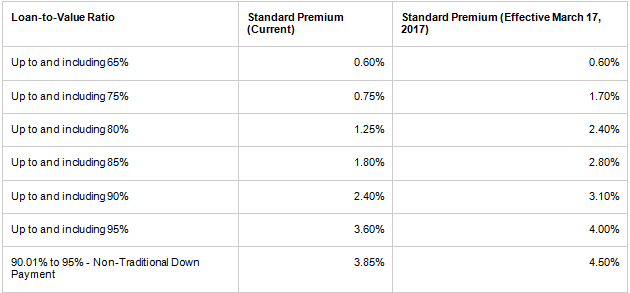

The Canadian Mortgage & Housing Corporation (CMHC) has announced they will be increasing their fees by over 10% in some cases as of March 17, 2017. As a homebuyer with less than 20% for a down payment, you may be wondering how the latest changes affect those unfortunate enough not to have a large down payment saved.

This is the third time in the last 34 months that there have been increases, and they apply to all with 5% down payment, amounting to a 45% increase. Those with 20% can usually opt out of paying any CMHC insurance.

Here is a breakdown of the premium changes.

And here are some examples from the CMHC and the breakdowns on how increases will affect monthly payments:

Down payment between 5% and 9.9%

$150.000 mortgage $2.82 PM

$250,000 mortgage $4.70 PM

$350,000 mortgage $6.59 PM

$450,000 mortgage $8.47 PM

$550,000 mortgage $10.35 PM

$850,000 mortgage $ 15.98 PM

Down payment between 10% and 14.99%

$150,000 mortgage $4.94 PM

$250,000 mortgage $8.23 PM

$350,000 mortgage $11.52 PM

$450,000 mortgage $14.81 PM

$550,000 mortgage $ 18.10 PM

$850,000 mortgage $27.90 PM

Down payment between 15% and 19.99%

$150,000 mortgage $ 7.06 PM

$250,000 mortgage $11.75 PM

$350,000 mortgage $16.46 PM

$450,000 mortgage $21.16 PM

$550,000 mortgage $25.86 PM

$850,000 mortgage $39.96 PM

Presented in this way it doesn’t seem like a lot of money, but consider this example: a $350,000 mortgage with a 5% down payment has an increase of $6.59 PM in monthly payments. Over the full amortization period that amounts to $1,977.00.

Why are they doing this?

The Office of the Superintendent of Financial Institutions is a government agency that requires the mortgage insurers (CMHC included) to hold additional capital. Capital holdings create a buffer against potential losses, helping to ensure the long term stability of the financial system.

To test a worst case scenario, with a US style housing correction the CMHC will be able to withstand it. Even an earthquake in a Canadian city that results in oil prices dropping between $20 to $30 a barrel and holding for the next four years will not cause any serious damage.

CMHC is a non profit program with reported profits of $9 billion over the past five years. If they could put even a third of that profit into a rainy day fund they would have enough to cover future losses in a worse case scenario. The reason that this is not possible is their profits go straight into government revenues with taxes, making these fees another form of taxation.

Contact me today if you are looking for a mortgage broker who can discuss your mortgage options including this tax increase.