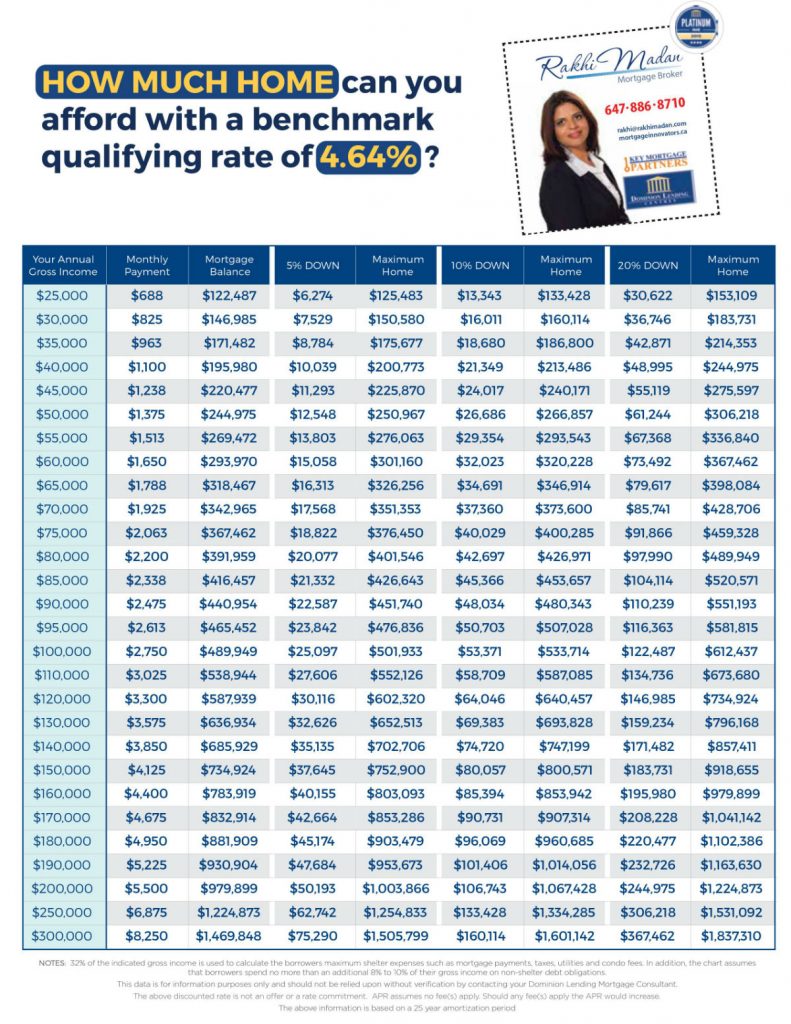

The Minister of Finance announced the fixed rate home buyers will now need to qualify for payments at the posted interest rate instead of the discounted interest offered by Toronto mortgage brokers like myself.

It’s important to know a few things about the changes to the new mortgage rules that take effect on October 17, 2016. Firstly it mostly affects the high ratio buyers. These are the buyers who have less than 20% down payment and therefore also need to pay the insurance through CMHC or a private insurance company. Next, you do not actually have to pay the higher interest, you just have to prove to the lender that you could pay it if you needed to, should the rates increase when you go to renew.

Here are a few ways you can get around these new rules.

If at all possible, bump up your down payment to above the 20% threshold for the CMHC insurance. This will enable you to qualify for a home with a higher purchase price.

Add another person on the mortgage to increase level of income

Consider adding someone to your mortgage to show the lenders you have sufficient income to cover the payments at the higher interest.

Rental income

Consider purchasing a house that has a rental suite. You can add this rent to your income to cover the extra cost of interest.

Purchase a lower price home

It may not be the ideal dream house you wanted but at least you’ll be prepared and have sufficient income to easily cover the mortgage, especially if rates go up.

Many are calling this change the voice of reason and see it as a great way to protect Canadian home buyers. However it will be interesting to see what effect it will have on the real estate market.

As with any changes to mortgage rules it’s important to discuss it with a Mortgage broker so you understand how it affects you. Contact me today for more information.