The housing market in 2024 was tough for Canadians. Even though rates came down, they were still too high for many clients trying to purchase, refinance, or renew their mortgages. Some people couldn’t qualify even though they had done many things right. While there was speculation the market would take off as rates dropped, that didn’t happen We were primarily in a buyers’ market for most of the year, allowing buyers the ability to take their time to shop around and get their finances in order, although there was a noticeable pick up towards the end of the year after two Bank of Canada jumbo 50 bps rate cuts.

The stage is now set for an intriguing 2025. Whether you’re planning to buy your first home, upsize, downsize, or refinance, understanding the market dynamics will help you make informed decisions. Here are some key considerations for both homebuyers and owners.

For Homebuyers: Opportunities to Watch in 2025

1 – Lower Rates, Greater Affordability

With the Bank of Canada’s overnight rate potentially dropping to as low as 2% or 2.25% by the end of the year, variable-rate mortgages may become increasingly attractive. Meanwhile, fixed rates, influenced by bond yields, are expected to remain stable or decline modestly. This creates an ideal environment for buyers seeking lower monthly payments or extra cash flow.

Tip: If you prefer stability, consider locking in a competitive fixed rate. For those open to fluctuations, a variable rate could align with your goals, especially as rate cuts continue. Either way, get in touch for a pre-approval before any rate consideration and discussion.

Where are rates heading?

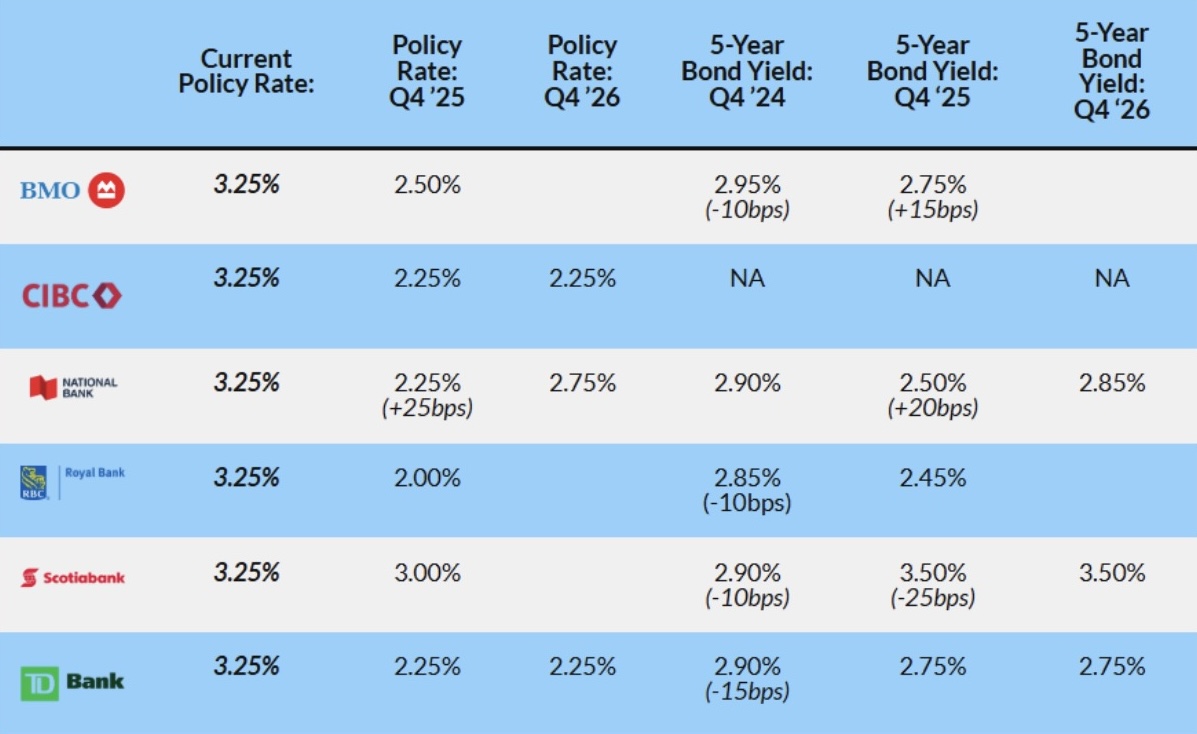

Here are the major Canadian banks’ most recent 2025 rate forecasts (Source: Canadian Mortgage Trends). Projections for the overnight rate, which directly impacts variable mortgage rates, range from 2% to as high as 3% by the end of 2025. With the current overnight rate sitting at 3.25%, this signals relief for variable rate holders.

Bond yield forecasts, which influence fixed mortgage rates, also show a wide range. While variable rates are expected to decrease, fixed rates may remain steady or experience a slight decline.

The takeaway? With market conditions improving and regulatory changes making housing more accessible, buyers and sellers may feel more confident in their decisions. This should result in increased activity in the market, especially in the spring and summer of 2025.

Rate predictions vary, and no one can predict how the market will evolve. That’s why having the right guidance is essential to securing the best mortgage, term, and rate tailored to your needs. Let’s navigate this dynamic market together!

2 – Explore New Mortgage Rules

The introduction of 30-year amortizations for insured mortgages and newly built homes reduce monthly mortgage payments, and the rise in the insured mortgage cap from $1 million to $1.5 million lowers downpayments for homes priced at $1-$1.5 million. These new regulations have made homeownership more accessible, especially for first-time buyers and those eyeing newly constructed homes. This is likely to bring more young families and new buyers into the market, fueling demand across the region.

Tip: To stretch your purchasing power, combine government programs like the First Home Savings account and the RRSP Home Buyers’ Plan with these new measures. Check out my detailed First Time Buyers Incentive page.

3 – Expand Your Search with Remote Work

With hybrid and remote work arrangements still popular, buyers have the flexibility to explore more affordable markets outside major cities. Smaller towns and suburban areas continue to offer excellent value.

Tip: Research growing neighborhoods with strong infrastructure plans, as these areas often see property value appreciation over time.

4 – Down Payment Strategies

Saving for a down payment remains a top priority. Whether your funds are self-saved or gifted, ensuring proper documentation is vital for lender approval.

Tip: Keep 90 days of bank statements ready for downpayment proof and, if receiving a gifted down payment, obtain a signed letter confirming it doesn’t need to be repaid.

For Homeowners: Smart Moves for the Year Ahead

1 – Consider Refinancing OptionsWith rates trending downward, refinancing may allow you to reduce your interest costs, consolidate debt, or fund home improvements. New refinancing rules allowing up to 90% of property value for building secondary units, coupled with Brampton’s by-laws permitting up to three units per property, will likely drive interest in creating income-generating suites. This could lead to a rise in multi-generational living and more affordable rental options, impacting housing density and rental supply.

Tip: Use refinancing to create rental income opportunities or improve your property’s value with upgrades.

2 – Renew Your Mortgage Strategically

If your mortgage is up for renewal, don’t simply accept your current lender’s offer. The recent elimination of stress tests for borrowers switching lenders at renewal makes it easier to shop for better terms.

Tip: Start exploring renewal options six months in advance and let me compare rates and products across multiple lenders.

3 – Leverage Your Home Equity

Rising home prices in 2025 could mean higher equity for many homeowners. Tap into this equity for renovations, education funds, or major life expenses.

Tip: Consult a financial advisor to determine if using your equity aligns with your long-term goals.

4 – Invest in Energy Efficiency

With government incentives for green home improvements, upgrading your home’s energy efficiency can lower utility bills and increase its market value.

Tip: Consider solar panels, energy-efficient windows, or heat pumps. These upgrades may qualify for grants or rebates, further reducing costs.

5 – Be Prepared for Market Shifts

While the real estate market is expected to gain momentum, unforeseen economic factors could impact trends. Stay informed about local market conditions and adjust your strategies as needed.

Tip: Keep an emergency fund ready for unexpected expenses or opportunities, such as purchasing investment properties in undervalued areas.

Final Thoughts: Planning Is Everything

2025 promises renewed activity in the real estate market, with opportunities for homebuyers and homeowners to benefit from favourable conditions. The combination of lower rates and higher demand may lead to modest price increases, particularly in highly sought-after areas of Brampton, Toronto, and the GTA. However, this will vary based on the specific neighborhood and property type.

You can make the most of this dynamic year by staying proactive, working with trusted professionals, and understanding the evolving landscape.

Whether you’re buying your first home, renewing your mortgage, or leveraging equity, having a solid strategy will set you up for success. Contact the best-rated mortgage broker in Brampton, and discover why my expertise, dedication, and client-first approach make me a trusted choice for your mortgage needs.